Statistics » About EUROFER statistics » EUROFER statistical definitions

EUROFER statistical definitions

Definitions

EUROFER publishes a range of statistical data, each compiled according to strict definitions and requirements to ensure that they are an accurate representation of the European steel sector's production, market supply and employment, as well as real and apparent steel consumption, and trade situation.

The relevant definitions are included below in order to aid users of EUROFER's statistics in understanding what they mean and what is and is not included in a given statistic.

Apparent consumption is also referred to as ‘steel demand’. It is total deliveries of all steel products and qualities by EU producers plus imports less 'receipts' into the EU, minus exports to third countries. In other words, apparent consumption is deliveries by EU producers plus imports minus receipts (that is, imports by EU producers themselves of material that is further processed), minus exports to third countries. EUROFER’s definition of apparent consumption includes all qualities, including stainless, and all finished products and semi-finished products.

If apparent consumption exceeds real steel consumption, the surplus is stocked in the distribution chain. If apparent consumption is less than real steel consumption, inventories are being withdrawn.

Real consumption is the use of all steel products used by steel-using sectors in their production processes, also referred to as the ‘final use’ of steel products, adjusted for the stock cycle.

Market supply is total deliveries made by EU producers onto the EU market plus imports from third countries, not including imports known as ‘receipts’, by EU producers themselves for further processing (to avoid double counting). In other words, market supply is total deliveries plus imports, minus receipts. This all qualities less stainless.

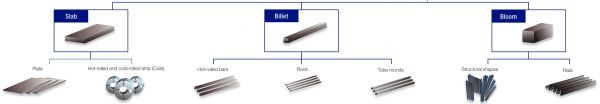

Crude steel is the term used to describe the first solid state of steel after it has solidified from its liquid state. It thus describes steel that is further transformed after having been cast into semi-finished products such as slabs, billets and blooms.

Finished steel is the term used to describe products obtained upon hot rolling/forging of semi-finished steel products, such as blooms, billets or slabs - colloquially known in the industry as 'semis'. These cover two broad categories of products, namely 'long' products and 'flat' products.

Semi-finished steel products - colloquially known in the steel sector as 'semis' are intermediate steel products, formed in modern steel facilities through continuous casting. These intermediate semi-finished steel products are subsequently further processed to become finished products.

There are three main categories of semi-finished steel product. These are:

Long products describe a category of products that are derived from billets and blooms. They are, as the name suggests, often long or narrow in their dimensions. They include:

Flat products are produced from slabs - a semi-finished product. These are generally sold either as flat sections, as is the case with 'quarto plate', or coils, either hot or cold, which are rolled lengths coiled up to make transportation easier.

Different types of flat products are:

Hot rolled (often abbreviated HR) flat steel products are made re-rolling 'semi-finished' slabs at a high temperature (above 1000°C) in plate mills, which produce quarto plates, or in hot strip mills which produce strips and coils. The resultant Hot Rolled Coils (HRC) can be cut to length or shipped directly to steel-users.or downstream processors.

Cold rolled steel is produced by 'cold' rolling of hot rolled sheet in a cold rolling mill. This rolling usually takes place in cold rolling mills at room temperature. Cold rolled strips are cut to produce cold rolled sheet or coil, often abbreviated 'CRC'. Cold rolled steels have different properties to the hot rolled steel stock they are made from, including having a better and brighter finish, closer dimensional tolerances, and specific mechanical and metallurgical properties.

Cold rolled steel is used in automobiles, such as cars, buses, trucks and other commercial vehicles, trains and shipbuilding, in white goods, consumer durables and for further processing into coated sheet products.

In both the apparent consumption and market supply statistics, the imports component of the calculation is written, in the EUROFER definition, as 'imports less receipts'.

The 'receipts' in this instance mean imports by EU producers themselves of finished or semi-finished steel products that are further processed by the producer and transformed into other products. In the publicly available EUROFER figures, only finished products are shown and thus impacted by the receipts calculation.

This correction is important because it prevents double-counting that would artificially inflate the size of the market. If an EU producer imports a tonne of hot rolled strip that it further processes into a tonne of cold rolled which it then delivers to the EU market - in an uncorrected calculation the import of one tonne would then become one imported tonne plus one EU-processed and delivered tonne. The imported tonne is thus corrected out in the import side of the market supply and apparent consumption figures.

This does not impact the publicly available EUROFER import and export statistics, where all finished steel imports or exports into or out of the EU regardless of their subsequent uses in the steel value chain.

EUROFER applies the so-called 'narrow definition' which excludes steel tubes and first transformation products from the product scope used for calculating steel consumption. Hence, the steel tube sector is a steel-using sector under this definition.

Steel intensity is the ratio of real steel consumption to steel weighted production in the steel-using sectors. This reflects the usually slightly negative impact on consumption of innovation in steel products, inter-material substitution, improvements in process efficiency and design, etc.

SWIP is the abbreviation for Steel Weighted Industrial Production index. It is used as a proxy for real steel consumption. Activity in the steel-using sectors is weighted with the relative share of each sector in total steel consumed by all sectors.