Press releases » CBAM simplification and effectiveness must go hand in hand - Improvements are urgently needed to enable steel decarbonisation investments in Europe

CBAM simplification and effectiveness must go hand in hand - Improvements are urgently needed to enable steel decarbonisation investments in Europe

Downloads and links

Recent updates

Brussels, 13 February 2025 – Following the high-level conference “A Carbon Border Adjustment Mechanism for Climate - Addressing carbon leakage to strengthen global climate action”, organised in Paris by the European Commission and the French Ministries of Finance, Economics and Climate Transition, EUROFER emphasises that simplification must go hand in hand with ensuring the instrument’s effectiveness. This means addressing key issues such as resource shuffling, exports, and the inclusions of products further down the value chain.

Alarmingly, during the conference, the Commission announced that legislative proposals on crucial aspects of the Carbon Border Adjustment Mechanism (CBAM), including exports provisions and coverage of downstream sectors, will only be presented at the beginning of next year. Furthermore, a top priority for securing steel decarbonisation investments in Europe - which is tackling resource shuffling - is currently not event listed in the Commission’s planning of upcoming legislative proposals.

This situation contradicts the clear political guidance and sense of urgency expressed by both French Ministries during the conference, and supported by other member states.

EUROFER is concerned about the differing timelines allocated to the simplification and effectiveness of CBAM. While the Commission is fast-tracking simplification through the Omnibus Package, the European steel industry remains deeply worried about the lack of urgency in ensuring CBAM’s effectiveness.

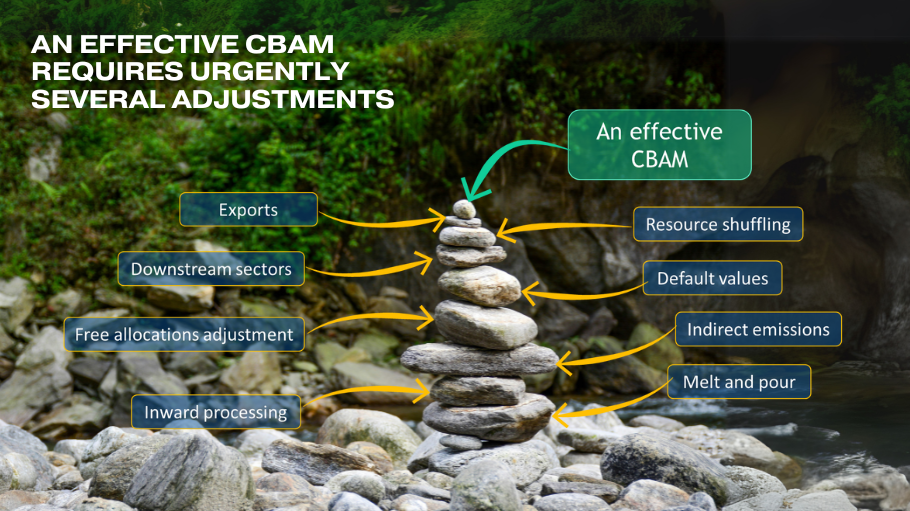

This year’s review of CBAM is critical to achieving both objectives. To ensure its effectiveness, a watertight design is needed. This urgently requires major improvements, including:

Additionally, other design elements - such as stringent default values and the free allocation adjustment - must uphold the mechanism’s environmental integrity.

If these adjustments are not implemented this year, the combination of CBAM and the scheduled phase-out of free allocation will fail to provide adequate protection against carbon leakage. This could further incentivise the relocation of production to third countries, negatively impacting both steel and downstream sectors.

While pursuing the effectiveness and environmental integrity of the mechanism, the administrative burden on operators should be minimised through simpler and streamlined procedures. The Commission has already planned certain simplifications as part of the Omnibus revision. In particular, a revision of the current de minimis threshold of €150 could be an appropriate adjustment to avoid unnecessary reporting for small consignments. Furthermore, CBAM reporting obligations should not apply to European products exported outside the EU, processed abroad, and subsequently reimported into the EU as CBAM goods. Effective monitoring should prevent such provisions from favouring circumvention practices.

In line with these recommendations, a more effective yet simpler CBAM is both possible and urgently needed. Launching it without the necessary improvements would further erode the competitiveness of the European steel industry. This is indispensable given that the EU carbon price has reached approximately 80€/t, while over 25 million tonnes of steel - equivalent to around 20% of EU production - are imported annually from third countries without any carbon cost.

Contact

Lucia Sali, Spokesperson and Head of Communications, +32 2 738 79 35, (l.sali@eurofer.eu)

About the European Steel Association (EUROFER)

EUROFER AISBL is located in Brussels and was founded in 1976. It represents the entirety of steel production in the European Union. EUROFER members are steel companies and national steel federations throughout the EU. The major steel companies and national steel federation of Turkey, Ukraine and the United Kingdom are associate members.

The European Steel Association is recorded in the EU transparency register: 93038071152-83.

About the European steel industry

The European steel industry is a world leader in innovation and environmental sustainability. It has a turnover of around €191 billion and directly employs around 303,000 highly-skilled people, producing on average 140 million tonnes of steel per year. More than 500 steel production sites across 22 EU Member States provide direct and indirect employment to millions more European citizens. Closely integrated with Europe’s manufacturing and construction industries, steel is the backbone for development, growth and employment in Europe.

Steel is the most versatile industrial material in the world. The thousands of different grades and types of steel developed by the industry make the modern world possible. Steel is 100% recyclable and therefore is a fundamental part of the circular economy. As a basic engineering material, steel is also an essential factor in the development and deployment of innovative, CO2-mitigating technologies, improving resource efficiency and fostering sustainable development in Europe.

Brussels, 02 July 2025 – The 90% climate target proposed today by the European Commission demands an unprecedented transformation of EU society and industry in just 15 years. The European steel industry is already doing its part, but a viable business case for the transition is still lacking. To enable it, the EU needs to implement the Steel and Metals Action Plan much more decisively, delivering a highly effective trade protection against global overcapacity, access to internationally competitive low carbon energy and scrap, and a watertight CBAM, says the European Steel Association.

How global overcapacity is destroying European industries

European Steel in Figures 2025 is EUROFER's statistical handbook, laying out in an easy-to-use format the key statistics and data about the performance and footprint of one of Europe's most important strategic sectors