Press releases » Global Forum on Steel Excess Capacity must "Finish the job it has started", says EUROFER

Global Forum on Steel Excess Capacity must "Finish the job it has started", says EUROFER

Downloads and links

Recent updates

Brussels, 27 March 2019 – Ahead of the Global Forum on Steel Excess Capacity (GFSEC) meeting on 28-29 March, the European Steel Association (EUROFER) calls for the forum’s mandate to be extended, ahead of its expiry in November. The GFSEC has begun an important transparency and policy process, but its work is not yet complete.

“We call on members of the Global Forum to agree on a continuation of the forum’s mandate beyond November 2019”, said Axel Eggert, Director General of EUROFER. “Continued international work on excess capacity and related government support measures would contribute to the sustainability of our global industry.”

The GFSEC was established in late 2016, on the instruction of G20 Leaders. The Forum set out to gather information and report on the evolution of steel supply and demand conditions, steel production capacity, and government policies that lead to global overcapacity, such as subsidies.

“GFSEC’s work has already produced results, such as detailed statistics on steel capacity and production around the world and has instigated work to cut excess capacity where it is needed most”, added Mr Eggert.

However, while progress has been made – notably an agreement in December 2017 on principles and recommendations whereby countries and regions dismantle market-distorting subsidies and other government support measures and share data and information on the process of capacity reduction – this is still the beginning of the process.

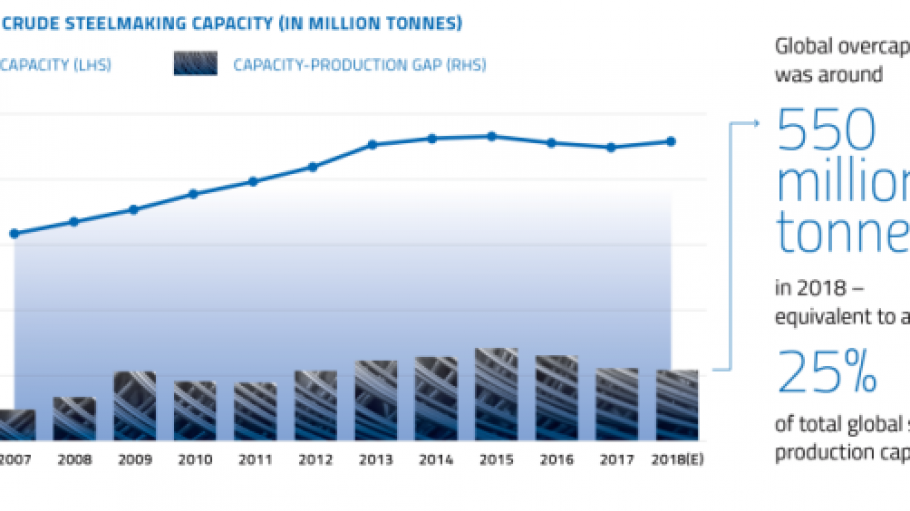

“Global steel overcapacity is still at least 550 million tonnes, according to the OECD”, emphasised Mr Eggert. “We are still very much at the beginning of the process, and there is clearly a need for the GFSEC’s mandate to be extended”.

Since the Forum’s first meeting two-and-a-half years ago, momentum has been steadily building; there is currently a clear level of commitment and resolve among the world’s major steel-producing countries to effectively tackle excess steel capacity, including its root causes. This momentum should not be lost, EUROFER believes.

“In a world where global overcapacity is still very much present – and with proliferating trade distortions – there is a greater need than ever for the GFSEC”, concluded Mr Eggert. “Not renewing the mandate of the Global Forum would mean abandoning the global steel industry when it is still at a perilous juncture. Effective multilateral cooperation is needed in order to preserve fair and free trade in this essential sector”.

Contact

Charles de Lusignan, Spokesperson and head of communications, +32 2 738 79 35, (charles@eurofer.be)

About the European Steel Association (EUROFER)

EUROFER AISBL is located in Brussels and was founded in 1976. It represents the entirety of steel production in the European Union. EUROFER members are steel companies and national steel federations throughout the EU. The major steel companies and national steel federations in Switzerland and Turkey are associate members.

About the European steel industry

The European steel industry is a world leader in innovation and environmental sustainability. It has a turnover of around €170 billion and directly employs 330,000 highly-skilled people, producing on average 160 million tonnes of steel per year. More than 500 steel production sites across 22 EU Member States provide direct and indirect employment to millions more European citizens. Closely integrated with Europe’s manufacturing and construction industries, steel is the backbone for development, growth and employment in Europe.

Steel is the most versatile industrial material in the world. The thousands of different grades and types of steel developed by the industry make the modern world possible. Steel is 100% recyclable and therefore is a fundamental part of the circular economy. As a basic engineering material, steel is also an essential factor in the development and deployment of innovative, CO2-mitigating technologies, improving resource efficiency and fostering sustainable development in Europe.

Download files or visit links related to this content

Developed with the support of the Offshore Wind Foundation Alliance and European Wind Tower Association, the position paper outlines the strategic importance of wind components for Europe’s green transition and calls for targeted measures to strengthen their role within the NZIA.

Brussels, 2 April 2025 - The latest data unveiled by the OECD in its meeting in Paris draw an extremely worrying picture, where global steel excess capacity is expected to grow from an estimated 602 million tonnes in 2024 to 721 million tonnes by 2027 – over five times the EU's steel production. The European steel industry - already severely hit by the spill-over effects of global overcapacity and the U.S. steel import tariffs - reiterates the crucial need for strict and effective EU post-safeguard measures to ensure its survival.

Brussels, 19 March 2025 – The Steel and Metals Action Plan, unveiled today by the European Commission, provides the right diagnosis to the existential challenges facing the European steel industry. Concrete measures need to follow swiftly to reverse the decline of the sector, re-establish a level playing field with global competitors, and incentivise investment and uptake of green steel in the market.